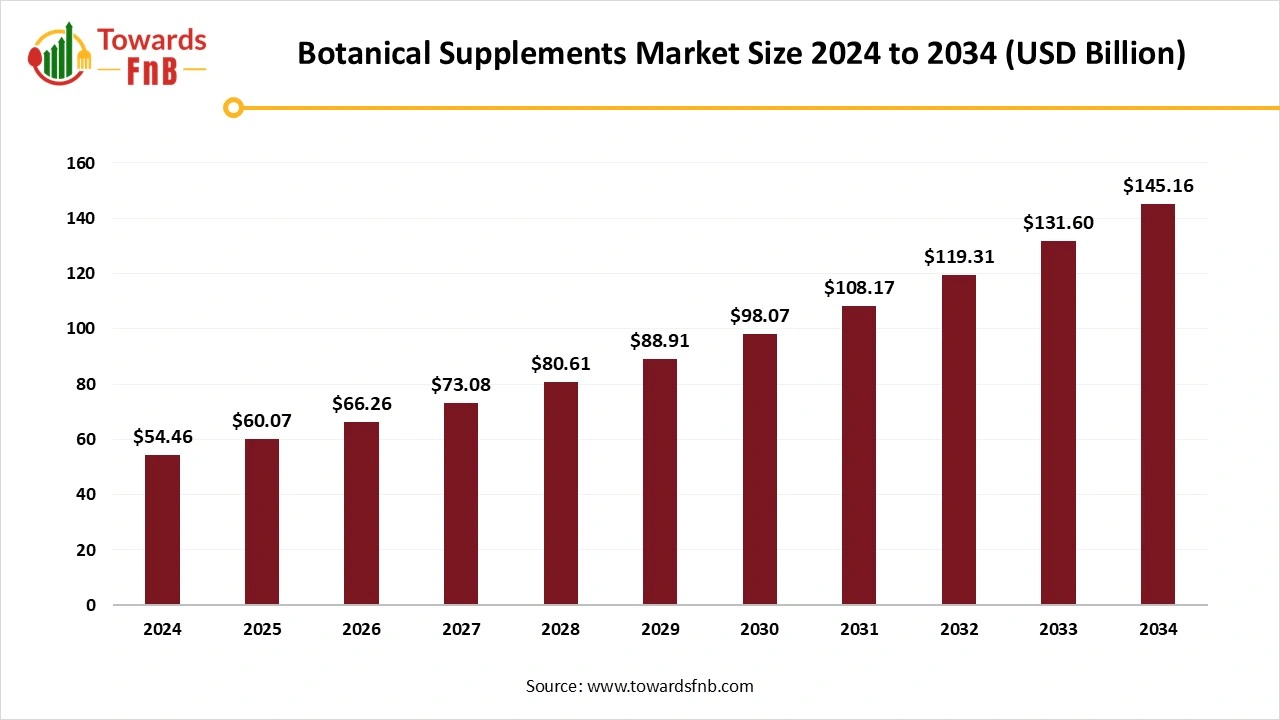

Botanical Supplements Market Set to Surge with 10.3% CAGR, Reaching USD 145.16 Billion by 2034

According to Towards FnB, the global botanical supplements market size is evaluated at USD 60.07 billion in 2025 and is anticipated to surge USD 145.16 billion by 2034, expanding to a healthy CAGR of 10.3% from 2025 to 2034. This significant growth reflects increasing demand for natural health solutions and a shift toward plant-based alternatives in wellness.

Ottawa, Nov. 21, 2025 (GLOBE NEWSWIRE) -- The global botanical supplements market size was valued at USD 54.46 billion in 2024 and is expected to rise from USD 60.07 billion in 2025 to reach around USD 145.16 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research. This increase is driven by the growing emphasis on natural ingredients and consumer demand for sustainable and clean-label products, aligning with broader wellness trends.

The market is expected to grow as consumer awareness of the benefits of botanical supplements and natural products rises. Use of natural and organic products helps maintain a healthy nutritional profile and allows consumers to avoid potential damage caused by excessive use of chemical and harsh supplements.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5921

Key Highlights of the Botanical Supplements Market

- By region, North America led the botanical supplements market in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By source, the leaves segment captured the maximum market share in 2024, whereas the flowers segment is expected to grow in the expected timeframe.

- By form, the tablet segment led the botanical supplements market in 2024, whereas the liquid segment is expected to expand in the future.

- By application, the energy and weight management segment dominated the botanical supplements market in 2024, whereas the anti-cancer segment is expected to grow in the forecast period.

- By distribution channel, the offline segment held the largest share in 2024, whereas the online segment is expected to grow in the foreseeable period.

Multiple Health Benefits are helpful to fuel the Growth of the Botanical Supplements Industry

The botanical supplements market is expected to grow due to rising demand for natural and organic products and a growing focus on preventive healthcare and plant-based solutions. Organic and natural health supplements are made from natural ingredients such as leaves, flowers, and medicinal herbs. Hence, such supplements are high in bioactive compounds, antioxidants, and flavonoids. They have no side effects and help support the ongoing treatment. Hence, such factors help drive market growth. These supplements have been proven to improve digestion, boost immunity, and support skin and hair health. Hence, such an array of benefits helps to boost the industry’s growth.

Major Brands of the Botanical Supplements Industry

- Amway (Nutrilite)- the brand is a well-renowned botanical supplements supplier globally. It offers various herbal and plant-based vitamins and other supplements.

- Dabur India- a brand from India with a huge product portfolio involving different types of herbal and plant-based products. Consumers in India highly use the brand's products due to the brand's trust and reliability over the years.

-

Gaia Herbs, a leading US manufacturer of botanical supplements and plant-based products, believes in transparency and sustainability, which contribute to market growth.

Impact of AI in the Botanical Supplements Market

Artificial intelligence is significantly influencing the botanical supplements market by improving product development, quality assurance, and supply chain efficiency. In research and formulation, AI-powered algorithms analyze clinical studies, phytochemical databases, and consumer health data to identify the most effective botanical combinations for targeted benefits such as immunity, stress reduction, digestion, and cognitive support. Machine learning models simulate how different herbal compounds interact, helping manufacturers design more potent, bioavailable formulations with fewer trials and errors.

In manufacturing, AI-driven predictive analytics optimize extraction, concentration, and drying processes to ensure consistent potency and purity of botanical ingredients. Computer vision systems monitor raw plant materials for adulteration, moisture levels, and color variations, enabling real-time detection of impurities and ensuring compliance with safety and quality standards. These tools are especially critical for botanical supplements, which often depend on natural variability in plant sources.

Recent Developments in the Botanical Supplements Market

- In July 2025, Herbalife launched a new dietary supplement- MultiBurn, formulated with botanical extracts for weight loss and metabolic health.

- In April 2025, Vivazen, a well-renowned name in the functional and plant-based supplements industry, launched its Botanical Gummies. These gummies help to energize, focus, relax, and elevate mood.

New Trends of the Botanical Supplements Market

- Higher consumer interest in plant-based, organic, and functional supplements and products is one of the major factors for the growth of the market.

- No side effects, but multiple health benefits: another major mantra helpful for market growth.

- Technological advancements and product innovation also help to fuel the growth of the botanical supplements industry.

- Availability of botanical supplements on various e-commerce platforms with ease is another major factor for the market’s growth.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/botanical-supplements-market

Trade Analysis of the Botanical Supplements Market

Import & Export Statistics

Export Leadership and Shipment Intensity

- Shipment trackers show concentrated exporter activity for botanical extracts. In the most recent 12-month period, Vietnam accounted for the largest share of tracked botanical extract exports, representing roughly 53 percent of recorded shipments, followed by the United States and Oman. This pattern reflects strong processing and export orientation in Southeast Asia.

- For herbal supplements more broadly, shipment-level data identify Malaysia, India, and the United States among the top exporters by shipment count, with Malaysia recording thousands of tracked shipments in recent tracker windows. These exporters supply both finished supplements and ingredient extracts to major consumer markets.

Importer Demand Hubs and Market Orientation

- Major import markets for botanical supplements include the United States, the European Union, Japan, and the Middle East, where demand is driven by nutraceutical, cosmetic, and traditional-medicine applications. Importers typically source both refined extracts and finished supplement preparations, depending on regulatory acceptance and consumer preferences. Public trade trackers and customs portals consistently list these regions among principal buyers.

Product forms and trade characteristics

- Cross-border trade occurs in several forms: crude botanical raw materials, concentrated extracts, standardised curcuminoid/cannabinoid or flavonoid powders, and finished capsule or tablet supplements. High-purity extracts and certified standardised ingredients travel in smaller consignments with higher unit values, while crude botanical shipments are larger and have lower value per kg. Volza and customs logs show this split in shipment counts and unit-price patterns.

Regulation, certification, and trade barriers

- Regulatory frameworks shape trade flows. Exporters supplying the EU, the US, or Japan must meet food additive, supplement labelling, and safety dossier requirements. Some countries publish specific notifications for food supplements containing botanicals and impose export or labelling conditions that affect market access. For example, export policy notices and ITC/HS guidance have been used to manage shipments of botanical supplements in several jurisdictions.

Product Survey of the Botanical Supplements Market

| Product Category | Description / Function | Common Forms / Variants | Key Applications / End Use Segments | Representative Producers / Brands |

| Herbal Extract Supplements | Concentrated plant extracts standardized for key active compounds. | Ashwagandha, ginseng, ginkgo, turmeric, milk thistle | Stress relief, cognitive health, joint health | Gaia Herbs, Nature’s Way, NOW Foods |

| Whole Herb Powders | Minimally processed dried and powdered botanicals with naturally occurring actives. | Moringa, spirulina, wheatgrass, holy basil | Smoothies, capsules, energy blends | Organic India, Sunfood Superfoods, Terrasoul |

| Botanical Complexes and Blends | Multi-herb formulations designed for specific health outcomes. | Stress blends, immunity blends, liver detox blends | Wellness, immunity, and digestion | Himalaya Wellness, Garden of Life, Solgar |

| Adaptogen Supplements | Botanicals that support stress response, energy, and hormonal balance. | Ashwagandha, rhodiola, maca, schisandra | Stress relief, mental stamina, hormone balance | KSM 66 brands, Gaia Herbs, Four Sigmatic |

| Botanical Antioxidant Supplements | Plant-derived antioxidants for cell protection and anti-aging benefits. | Grape seed extract, green tea extract, resveratrol | Skin health, immunity, heart health | Puritan’s Pride, Life Extension, Jarrow Formulas |

| Botanical Digestive Health Supplements | Plant-based products that support digestion and gut comfort. | Peppermint, ginger, fennel, aloe vera | IBS relief, nausea, digestive wellness | Enzymedica, Nature’s Bounty, Swanson |

| Immunity Focused Botanical Supplements | Herbs are traditionally used to strengthen the immune response. | Elderberry, echinacea, astragalus | Immunity boosters, seasonal wellness | Sambucol, Nature’s Answer, Zarbee’s Naturals |

| Botanical Sleep and Relaxation Supplements | Natural botanicals support sleep quality and calm the nervous system. | Valerian, chamomile, passionflower, lavender | Sleep aids, relaxation formulas | Natrol, Olly, Source Naturals |

| Botanical Beauty and Skin Health Supplements | Plant extracts are used for collagen support, hydration, and anti-inflammatory benefits. | Amla, bamboo silica, evening primrose oil | Beauty from within, hair, and nail health | HUM Nutrition, Vital Proteins plant blends |

| Women’s Health Botanical Supplements | Herbal formulas supporting hormonal balance, PMS relief, and menopausal comfort. | Black cohosh, chasteberry, evening primrose oil | PMS, menopause, reproductive health | New Chapter, Nature’s Way, Pure Encapsulations |

| Botanical Heart Health Supplements | Plant extracts supporting healthy lipid levels and cardiovascular function. | Garlic extract, hawthorn, bergamot | Heart wellness, cholesterol support | Kyolic, Solaray, Life Extension |

| Botanical Sports and Energy Supplements | Natural stimulants and endurance botanicals. | Green tea, cordyceps, ginseng | Pre-workout, endurance, energy | Four Sigmatic, Nootropic blends, GNC plant lines |

| Liquid Botanical Extracts and Tinctures | Alcohol or glycerin-based extracts for faster absorption. | Echinacea tincture, valerian tincture | Quick dose wellness, naturopathic use | Herb Pharm, Nature’s Answer |

| Functional Botanical Drinks and Shots | Ready-to-drink botanical wellness formats. | Turmeric shots, ashwagandha drinks, ginger shots | Functional beverages, convenience wellness | Vive Organic, Suja, Remedy Drinks |

| Botanical Essential Oils for Supplement Use | Oils derived from botanicals are used internally in some regulated markets. | Oregano oil, clove oil, peppermint oil | Immune support, digestion, and microbial | DoTerra (select lines), Plant Therapy, Zane Hellas |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5921

Botanical Supplements Market Dynamics

What are the Growth Drivers of the Botanical Supplements Market?

Various factors, such as higher demand for organic products and natural supplements, growing awareness of health and wellness, the health benefits of botanical supplements, and the growing use of home remedies, are major drivers of market growth. Botanical supplements have no disadvantages and thus help fuel the market. Disturbed lifestyle and improper eating habits leading to issues such as diabetes, high cholesterol levels, and obesity also help to elevate the growth of the market.

Challenge

Disturbed Quality Control Is Hampering the Market’s Growth

Disturbed ingredient quantity and quality can affect the potency and efficacy of botanical medicines, further hindering market growth. Issues with raw material availability, improper processing techniques, and damaging environmental factors are other major factors that may hamper the market's growth. Adulteration during the manufacturing of such medicines is another issue that may affect the growth of the botanical supplements market.

Opportunity

Technological Advancements Are Helpful for the Market’s Growth

Improved technology in the form of advanced methods, such as vertical farming, AI, blockchain, and various other technological tools. Advancements in extraction and delivery methods also help fuel the market's growth. It further enhances transparency and improves quality, which supports the growth of the botanical supplements market.

Botanical Supplements Market Regional Analysis

North America Led the Botanical Supplements Market in 2024

North America dominated the market in 2024 due to high demand for natural and organic products across various domains, which drove market growth. Higher demand for organic personal care products, health and wellness products, and supplements helps to elevate the market. Government support, higher consumer demand, and the multiple health benefits of botanical supplements are other major factors driving market growth in the foreseeable future. The US plays a major role in the region's market growth, driven by higher consumer demand for plant-based supplements.

Asia Pacific Is Expected to Grow in the Foreseeable Period

Asia Pacific is expected to grow over the forecast period due to higher demand for plant-based and organic products, rising disposable income, and the availability of numerous plants and herbs with medicinal properties. The region is one of the largest exporters of herbs and medicinal plants, further boosting market growth. Countries such as India, China, and Japan have made major contributions to the market's growth due to higher use of traditional medicines in the region, along with increased demand for organic products. India further helps elevate the regional market by offering a range of medical practices, including Ayurveda, Unani, Siddha, and homeopathy.

Europe Is Observed to Have a Notable Growth in the Foreseeable Period

Europe is expected to experience notable growth in the near term due to the growing elderly population in the region. Hence, the region’s inclination is higher towards natural and organic products and supplements. Countries such as Italy and Germany have made major contributions to the market's growth. Consumers in such countries primarily prefer home remedies, botanical supplements, and various herbal products, further fueling market growth.

Botanical Supplements Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 10.3% |

| Market Size in 2025 | USD 60.07 Billion |

| Market Size in 2026 | USD 66.26 Billion |

| Market Size by 2034 | USD 145.16 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Botanical Supplements Market Segmental Analysis

Source Analysis

The leaves segment dominated the botanical supplements market in 2024 due to their bioactive compounds, which are driving market growth. The natural benefits of using leaves in the manufacturing of botanical supplements include aiding weight loss, improving immunity and strength, nourishing the internal system, and supporting hair and skin health. An ideal example of the use of leaves for multiple health benefits is green tea and moringa leaves, which primarily aid weight management, along with other health benefits. The segment also includes other benefits, such as improved digestion, lower cholesterol levels, and better heart health.

The flower segment is expected to grow over the forecast period due to its multiple health benefits, which will help fuel the growth of the botanical supplements market. Such supplements are antioxidant-rich, anti-inflammatory, and offer a range of other health benefits. Developing technologies are improving extraction methods, thereby increasing the effectiveness of such supplements, further fueling the market's growth. Multiple health benefits, sustainability, and organic sources are among the other major factors driving the segment's growth, further fueling the market.

Form Analysis

The tablet segment dominated the botanical supplements market in 2024 due to the various benefits of the form. They are easy to consume and carry, with an extended shelf life. Tablets provide accurate measurements of various ingredients and are therefore ideal for consumption, further fueling the market's growth. The segment also observes growth due to its ease of consumption across different age groups, further fueling the botanical supplements industry. The segment also observes growth due to consumers who can easily have their tablets with them on the go, even when outdoors.

The liquid segment is expected to grow over the forecast period due to its ease of consumption, which is helpful for patients who are unable to swallow tablets or pills. Liquid supplements can also be mixed into various food and beverages to make them more palatable. It is highly useful for feeding kids and elderly people who might not find the taste of supplements palatable enough. Hence, when such factors combine, they help enhance market growth.

Application Analysis

The energy and weight management segment led the botanical supplements market in 2024, driven by the growing number of consumers with obesity, cardiovascular problems, reduced appetite, and diabetes. Disturbed lifestyles and improper eating habits are also among the major reasons consumers demand organic supplements. Hence, such supplements help manage the issue using organic, natural ingredients, which are helpful for market growth.

The anti-cancer segment is expected to be the fastest-growing segment over the forecast period due to the multiple health benefits of these supplements in treating fatal conditions such as cancer. Botanical supplements are rich in bioactive compounds, flavonoids, and antioxidants, which help improve cellular health and support standard treatment for issues, further fueling the growth of the botanical supplements market in the foreseeable period. Higher consumer demand for natural and organic supplements, driven by their multiple health benefits and lack of adverse effects, also helps elevate market demand.

Distribution Channel Analysis

The offline distribution segment led the botanical supplements market in 2024 due to consumers' greater trust in shops and stores that offer such supplements, which is beneficial for market growth. Such stores have built consumers' trust over the years, along with detailed information about new and diverse products, which has helped market growth. Safety and credibility are other major factors driving market growth.

The online distribution segment is expected to grow in the foreseen period due to its convenience, allowing consumers to shop for the required supplements from the ease of their home. Online platforms offer multiple options, allowing consumers to browse in detail with complete knowledge and reviews, which is further helpful for market growth. The online segment also offers multiple discounts, making it an economical purchase and enhancing market growth.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 464.58 billion by 2034, growing from USD 192.68 billion in 2025, at a CAGR of 9.2% from 2025 to 2034.

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Botanical Supplements Market

- Dabur India: A leading herbal and Ayurvedic products company offering a wide portfolio of botanical supplements, health tonics, and plant-based remedies. Dabur emphasizes traditional formulations supported by modern manufacturing.

- NBTY Inc.: A major global manufacturer of vitamins, minerals, and botanical supplements sold through brands like Nature’s Bounty and Solgar. The company focuses on science-backed formulations and broad retail distribution.

- Ricola AG: Known for its herbal lozenges and botanical cough remedies made from Swiss alpine herbs. Ricola leverages proprietary blends and sustainable herb cultivation practices in its natural wellness products.

- PLT Health Solutions: Supplies proprietary botanical ingredients used in dietary supplements, functional foods, and nutraceuticals. Its portfolio includes clinically studied plant extracts focused on immunity, cognition, and metabolic health.

- Mondelez International: Through select brands and product lines, the company engages in functional and botanical ingredient innovations within snacks and wellness-oriented offerings. Mondelez is increasingly integrating plant-based ingredients into new formulations.

- Procter and Gamble: Participates in the botanical supplement space through select health and wellness brands incorporating plant-derived ingredients. The company emphasizes quality, consumer safety, and clinical testing in its supplement offerings.

- Nutraceutical International Company: A producer of botanical and natural dietary supplements sold across multiple specialty brands. The company focuses on herbal extracts, plant-based wellness formulas, and clean-label manufacturing.

- BASF SE: Supplies botanical extracts and plant-based bioactives used in dietary supplements and functional nutrition. BASF emphasizes science-driven ingredient development, safety validation, and global regulatory compliance.

- The Himalaya Drug Company: A global leader in herbal health supplements, known for clinically studied Ayurvedic formulations based on traditional botanicals. Himalaya offers products for immunity, digestion, stress, and general wellness.

- Glanbia Nutritionals: Provides botanical ingredients, custom formulations, and nutritional premixes for supplement brands. Glanbia integrates plant-based extracts into solutions focused on active nutrition and functional health.

- Botanicalife International of America, Inc.: Specializes in premium botanical extracts and functional plant ingredients for dietary supplement manufacturers. The company emphasizes purity, standardized actives, and sustainable sourcing.

- Blackmores Limited: An Australian leader in natural health products and botanical supplements, offering plant-derived solutions for immunity, sleep, joint health, and overall wellness. Blackmores prioritizes clean sourcing and clinical backing for its products.

Segment Covered in the Report

By Source

- Herbs

- Leaves

- Spices

- Flowers

- Others

By Form

- Powder

- Liquid

- Tablets

- Capsules

- Gummies

- Others

By Application

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Others

By Distribution Channel

- Offline

- Online

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5921

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.